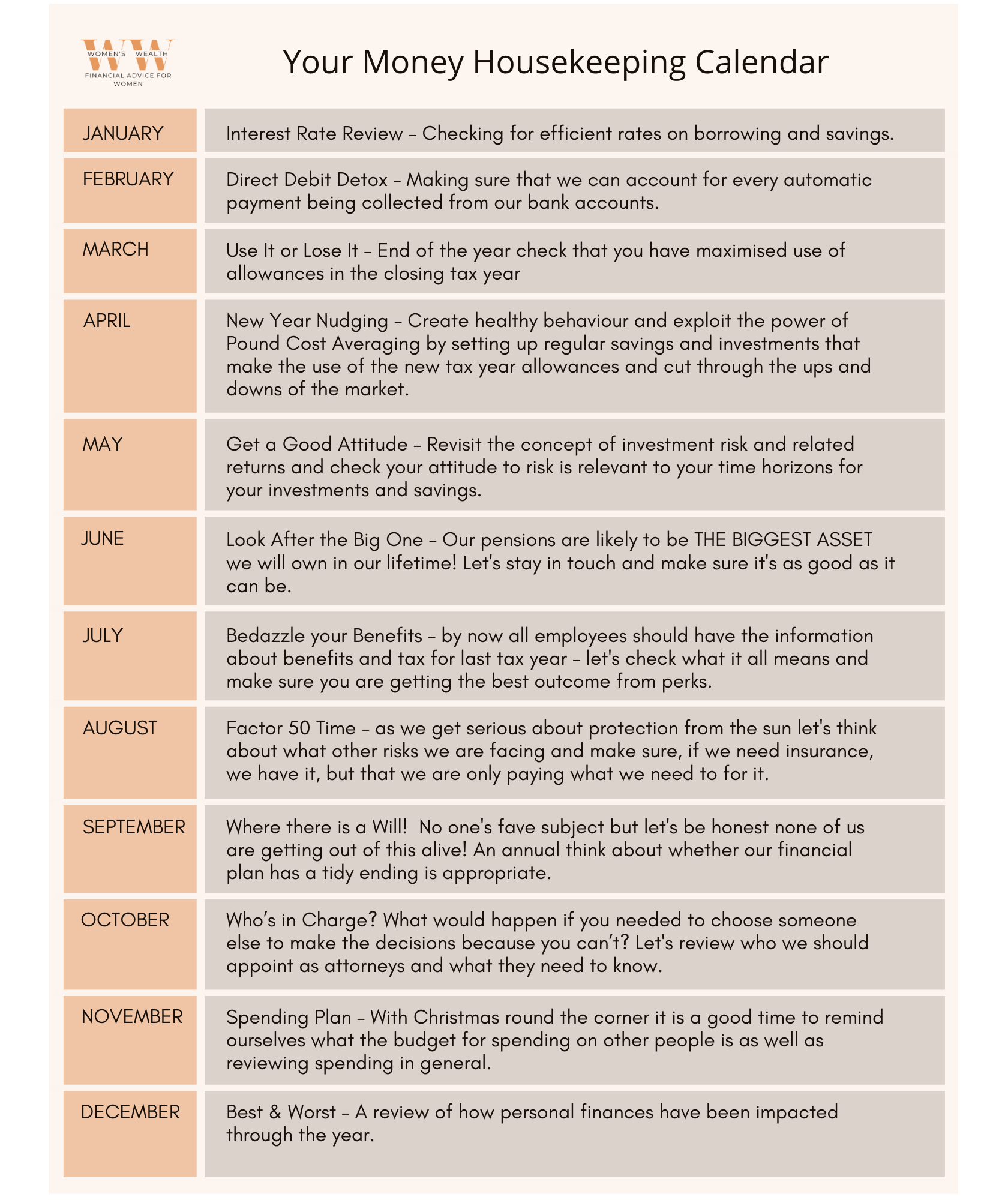

Each month we offer a Money Housekeeping exercise in the hopes we can be useful to you in your commitment to create a fabulous financial future for yourself.

Here is the calendar

January

Interest Rate Review – 3 Easy Steps – Worksheet Included

- Are you paying too much interest on debts?

- If you are paying more than 3% on your mortgage, over 2.8% on a personal loan or 22% on credit cards you may want to consider rebroking your debt.

- Are you getting what you deserve on savings?

- If you are getting less than 0.6% on savings you can do better.

- There could be a good reason why you haven’t got super competitive rates – maybe a high loan to value on the mortgage or your savings account provides other worthwhile perks, but just check you are getting what you deserve.

Step1

The first step in this challenge is making an up to date list of your loans and savings accounts. Use the worksheet or, log onto the Women’s Wealth portal if you are a member – this is part of getting financially fit – next year when you repeat rate review the first thing that will become obvious is whether you have more debt or savings accounts than last year

Step 2

You may need to log onto the online accounts or review statements to find out what current interest is being charged or paid depending on whether it is borrowing or saving – record the rates on your portal/worksheet.

Step 3

Use some of the following tools to check what is a competitive current rate and decide if you need to consider taking action to improve efficiency. Remember the best borrowing and savings rates are usually offered to larger account customers, and especially with borrowing, you will need to satisfy the providers criteria before actually being entitled to the best rates advertised.

https://www.moneysavingexpert.com/

https://www.moneysupermarket.com/

How much cash should you have as an emergency fund?

Having an emergency lump sum is really important and we provide some help in Enable Academy on how to calculate what you need, but as a quick test it should be a sum big enough to cover at least 3 months of your committed spending – even if interest rates are low, you still need to keep this in an ‘instant access’ cash account.

On the other hand, if you have more than 6 months of committed spending tucked away in cash then you should have a plan to spend the excess cash within 5 years – maybe on travelling, education, house deposit or home improvements – if you have no plan to spend the surplus within 5 years then it should be invested because it is losing its buying power- cash can’t compete with inflation, this is an economic fact of life and too much cash makes you poorer in the long run.

How much debt can I afford?

When we can borrow money at low rates it is tempting to enjoy savings and spending over being debt free because it is easily affordable.

Generally we believe there will be a day in the future when we will owe nothing, but it is often a distant expectation associated with later life, maybe once we own our home and have progressed our careers and are earning more? In the meantime most of us use borrowed money and are happy to pay the manageable rates of interest.

However, interest rates are on the rise and debt is set to be more expensive in the future. It is really important to test whether you can still afford the repayments when the rates increase.

We have grown used to low interest rates but it hasn’t always been this way and to help with a reality check we have included a column on the worksheet to help you check that your current debts remain affordable if interest rates increase by 3% which is a very possible scenario in the coming years.

Here is some useful information to help you navigate the acronyms and terms you will meet when looking up current rates of interest:

APR on Borrowing

| Acronym | Description | Where it is used | Good to know |

|---|---|---|---|

| APR – Annual Percentage Rate | Official rate used to help you understand the cost of borrowing. It takes into account the interest rate and additional charges of a credit offer. | All lenders have to tell you what their APR is before you sign a credit agreement. | Expressed as a percentage of the amount you’ve borrowed. For example, a personal loan with a 15% APR should be cheaper than one with a 17.5% APR, although you should always check the terms and conditions. |

| RAPR – Representative Annual Percentage Rate | The representative APR is an advertised rate that at least 51% of those accepted for the credit deal will get. | When lenders advertise their interest rates | Almost half the people who are approved for the deal may not be eligible for the advertised rate, and have to pay more. |

| PAPR – Personal Annual Percentage Rate | A personal APR is the rate you’re actually given – this could be the same as the representative rate, or it could be higher, depending on your eligibility. | When lenders make a specific offer to lend based on your personal circumstances but before you are committed to the loan. | The lender will usually decide what rate to offer you based on how your credit and financial information matches their criteria. |

AER on Saving

| Acronym | Description | Where it is used | Good to know |

| AER – Annual Equivalent Rate | Official rate for savings accounts, and is designed to allow easy comparisons as it’s meant to smooth out the variances between accounts (it’s the equivalent of the APR for debts). | Savings account providers have to provide this information on accounts they offer. | As it is the Annual Equivalent it can be of limited value, if not outright confusing, when accounts have introductory rates, bonus periods of less than a year or pay interest monthly! |

Interest Rate Review – Worksheets to DOWNLOAD

CLICK ON THE LINK BELOW TO DOWNLOAD THE WORKSHEET

Examples below

List your accounts

Mortgage, loans, credit cards, pay later or instalment plans

| Account | Balance | Interest Rate | Monthly Repayment | Monthly payment if rates 3% higher | Notes |

Example – loan | 2,400 | 3% | £144.33 | £147.44 | I year 5 months still to go |

| Example Mortgage Repayments | 280,000 | 3% | £1804.04 | £2,349.75 | 25 years still to go |

| Totals | 282,400 | £1,948.37 | £2,497.19 | £549 increase if rates rise by 3% on our debts! |

Personal Loan Calculator https://moneyfacts.co.uk/loans/loan-calculator/

Mortgage Repayment Calculator https://www.moneyhelper.org.uk/en/homes/buying-a-home/use-our-mortgage-calculator

Savings

| Account | Balance | Interest Rate | Gain over 1 year | Gain after allowance for 5% inflation | Notes |

| Example -Bank | £4,500 | 0 | 0 | -£200 | Reduce the balance as losing money |

| Example Cash ISA | £18,000 | 0.65% | £117 | -£783 | Can’t reduce as need for emergencies even though it is going backward against inflation. |

| Totals | £22,500 | £117 | -£983 | Move current account surplus to cash ISA |

This is a helpful guide to how Inflation is impacting you https://www.moneyhelper.org.uk/en/savings/how-to-save/inflation-what-the-saver-needs-to-know